Local Government is the tier of government that most impacts our daily lives.

From roads, footpaths, household waste, open spaces, planning, community events, and facilities, councils deliver a wide range of services and manage millions of dollars worth of infrastructure and public assets.

However, local councils in Australia and the United Kingdom are facing a funding crisis. This has prompted the NSW Government to review how local councils are funded.

How are NSW Local Councils Currently Funded?

Local council revenue comes from three main sources – rates and levies, user charges/sales of goods and services and grants from federal and state governments.

Funding is also derived from fees, fines and charges, asset sales, commercial activities (for example, The Canopy in Lane Cove), interest earned on investments and government grants.

Councils borrow funds from time to time (for example, Lane Cove Council has a T- Corp loan to assist in building the Lane Cove Sports and Recreation Facility).

NSW Local Government Funding Crisis

Local councils are being called upon to deliver more services without a corresponding revenue increase.

Local Government NSW (LGNSW) has been vocal about cost shifting without consulting local councils.

Cost shifting is when state or federal governments transfer, or ‘shift’, responsibility for providing a certain service, concession, asset or regulatory function to councils.

Local Government NSW (LGNSW) has found that local government ratepayers are funding more than a billion dollars of State Government obligations, according to the 2021-22 Cost Shifting Survey.

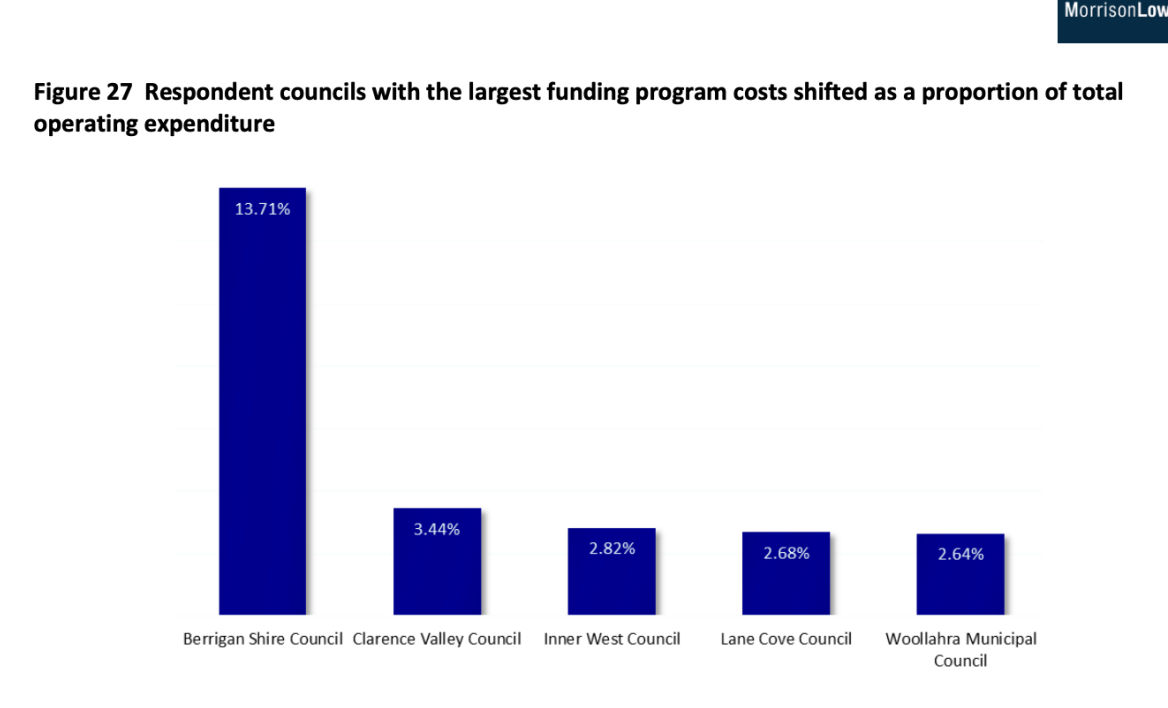

The respected consulting firm Morrison Low conducted the 2021-22 Cost Shifting Survey. The report revealed that cost shifting totalled $1.36 billion in 2021-22, far exceeding historical records and representing an increase of $540 million since the Survey was last carried out in 2017-18.

Local Government NSW, Cr Darriea Turley AM, said the findings of the report are alarming and should shock every ratepayer.

“It’s just not acceptable for the State Government to use local councils as a piggy bank for State programs and services,” Cr Turley said.

“This is effectively a $1.36 billion dollar tax on every ratepayer in NSW.

“At a time when councils are still rebuilding after the natural disasters of the past few years, the last thing they need to be doing is paying for State Government obligations too.”

NSW Government Announces Local Government Funding Review

A NSW Labor Government election commitment was to implement a review of the financial model for local government to address rising cost pressures facing councils across the state.

Yesterday (30 January 2024), the State Government announced it has asked the Independent Pricing and Regulatory Tribunal (IPART) to examine local councils’ financial models and key factors impacting their financial sustainability.

The review will assess the resources currently available to councils, their capacity to cover ongoing expenses and their ability to fund core council services and infrastructure for their communities.

It will also identify ways to improve budgetary performance and accountability within the sector so that democratically elected councillors are empowered to make decisions that ensure the effective running of their councils.

This financial modelling review will provide a holistic view of the challenges impeding the sector’s financial sustainability to ensure councils deliver value to their communities through responsible fiscal decisions.

IPART will consider and recommend improvements on matters including:

- The visibility of councillors and the community over the financial and operational performance of their councils;

- Whether the current budget and financial processes of councils are delivering value for money for ratepayers and residents;

- Whether the current funding model will sustainably support the needs of communities;

- Whether councillors and council staff have the financial capacity and capability to meet the current and future needs of communities; and

- How better planning and reporting systems can improve long-term budget performance, transparency and accountability to the community.

Minister for Local Government Ron Hoenig said:

“The financial sustainability of councils is one of the most significant issues facing local government in this state.

“With the cost of delivering core services to communities rising, it’s critically important councils are financially sustainable, but that needs to be balanced with the impact on tightening household budgets.

“That’s why we’ve asked IPART to make recommendations about whether the current financial model of councils enables long-term financial sustainability and whether councils have the financial capacity and mechanisms needed to deliver budget improvements.

“There needs to be a closer examination so that the solution to financial challenges is not increasing revenue through raising council rates or seeking financial support from the State Government.

“This review is a key election commitment and will help ensure this vital tier of government can continue to deliver essential services to NSW communities.”

Have Your Say

You can read the Draft Terms of Reference here. IPART is asking for feedback on the terms of reference. Comments must be submitted by 15 March 2024.

Next Step

IPART will consult with councils and the public to develop a report due to the Government 12 months after finalising the Terms of Reference.

UK Save Our Services Campaign

In the United Kingdom, the Local Government Association has started a Save Our Services campaign (see below).

Background – Cost Shifting Areas

The increase in cost shifting has been accelerated by various State Government policies, with the most significant examples of cost shifting in 2021-22 being:

- The waste levy, which remains the largest single contributor to cost shifting in NSW, totalling $292.9 million.

- The Emergency Services Levy and associated emergency service contributions, which totalled $165.4 million and represented the largest direct cost shift to local councils.

- The NSW Government’s failure to fully reimburse local councils for mandatory pensioner rate rebates, resulting in councils losing $55.2 million.

- The NSW Government’s failure to cover the originally committed 50 per cent of the cost of libraries, resulting in an additional $156.7 million in costs to councils.

Cr Turley said the cost shift amounted to a rate burden of $460.67 on every ratepayer in NSW which is up to 50 percent of their total rates bill in some local government areas.

Lane Cove Named As One of the Hardest Hit Councils

Councils hardest hit include Berrigan Shire Council in the Southern Riverina, Clarence Valley in the state’s north, and Inner West, Lane Cove and Woollahra councils, all in Sydney.

Waste Levy

The waste levy was imposed to discourage landfill disposal and promote the reduction in the use of materials and the re-use, recovery or recycling of materials in New South Wales.

Revenue from the waste levy was to be returned bo local governments to assist in running circular economy initiatives. NSW Local councils have extensively criticised the waste levey and argue benefits aren’t flowing back to them and have aksed for the system to be overhauled.

Emergency Services Levy

After the 2022/2024 Lane Cove Council budget was released earlier this year, Lane Cove Council was hit with a higher-than-expected Emergency Services Levy (ESL).

The ESL is a cost imposed on councils and the insurance industry to fund the emergency services budget in NSW. The majority is paid as part of insurance premiums, with a further 11.7 per cent picked up by councils and 14.6% by the State Government itself.

A Lane Cove Council spokesperson told ITC:

“Lane Cove Council has just received advice that the Emergency Services Levy (ESL) payable for 2023/24 will be $1,186,681 which is a $224,207 (23%) increase on the 2022/23 figure of $962,474.

You can read more about the ESL here.

Library Funding

Lane Cove Council runs 3 libraries. The Lane Cove library has one of the highest loan rates in NSW.

The result of cost-shifting is that rates must be spread further.